HOW YOU CAN IMPROVE YOUR CREDIT SCORE IN CANADA

WHAT IS A CREDIT SCORE?

A credit score is a three-digit figure that indicates how likely you are to pay your debts on time, according to a credit agency e.g. Equifax and Transunion. Building a strong credit can help you qualify for loans and major purchases such as a home or a car. You may also be able to obtain lower interest rates on loans hence helping you save money in the long run.

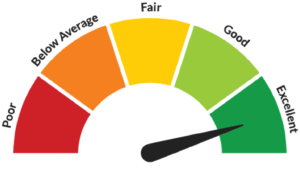

CREDIT SCORE RANGE

Credit scores in Canada range from 300 to 900. Though each possible lender will have its own set of criteria for what credit scores are acceptable, the Equifax range below is a good starting point

- Scores between 760 and 900 are regarded as outstanding.

- Scores of 725 to 759 are excellent.

- Scores of 660 to 724 are good.

- Fair scores range from 560 to 659.

- Poor scores range from 300 to 559.

The better your credit score, the more likely you are to get approved for credit cards and loans, as well as receive the best interest rates. Although you should strive for the greatest possible credit score, a credit score of at least 660 will normally qualify you for a number of loans and credit cards.

HOW CREDIT SCORE IS CALCULATED

Equifax and TransUnion are the two primary credit bureaus in Canada. These businesses gather information about your financial activities before distilling it into a credit score based on five important elements, as stated below.

Note: – determining your precise score without consulting the credit bureaus is impossible since they don’t publically reveal the formulae they employ in calculating the credit score

- Credit history – Your credit history accounts for 15% of your overall score. This is how long you’ve had each of your credit accounts open. Creditors like to see that you have a track record of managing debt properly, so the longer your credit history, the better.

- Credit utilization – Credit usage, which accounts for 30% of your credit score, determines how much of your total available credit you’re utilizing at any one moment. So, if the total borrowing capacity on all of your credit cards and lines of credit is $50,000, and you have $25,000 in outstanding amounts on that available credit, your credit usage ratio is 50%. In general, experts advise keeping your credit usage percentage around 35%.

- History of payment – The most important factor is your payment history, which accounts for 30% of your credit score. Payment history is a record of all your current and recent obligations (including credit cards, installment loans, and lines of credit), as well as whether you paid your payments on time. If not, it displays how late you were, if you skipped payments completely, or if an account went to collections.

- Public records – This category contributes for 10% of your total score and is obtained from public records, such as a history of bankruptcy or late debts forwarded to collection agencies.

- Credit inquiries – This element, which contributes for 10% of your score, considers how frequently and lately you’ve requested fresh credit. A “hard inquiry” (also known as a hard draw) is noted on your account when you ask about a loan or apply for a new credit card. Too many forceful pulls might be dangerous since they may suggest to potential creditors that you are in trouble financially and want supplementary finances.

How to improve your credit score

The following are the things you can do to improve your credit score in Canada

- Always pay your payments on time. This is not limited to credit cards alone. Late or missed payments on other accounts, such as cell phones, may be reported to credit agencies, affecting your credit ratings. If you are experiencing difficulty paying a bill, call the lender right away and try to negotiate a payment plan. It is important not to miss a payment even if you’re disputing a charge.

- Establish a credit history by obtaining a credit card and utilizing it for purchases that you would have made anyhow. If you have one or two credit cards, you can use them to do your purchases and pay the balance off on or before the due date. This can also be a way of managing cash flow since there is a grace period of 21 days normally after the statement is out. However, proper budgeting needs to be followed to ensure that there is a sufficient amount of money to pay off the debt.

- Don’t apply for or switch credit cards too frequently. Make an effort to keep your total debt under control and avoid allowing tiny sums to accumulate.

- Maintain a credit card balance that is well below the credit limit. A debt that exceeds your credit limit may have an effect on your credit score.

- Check your credit reports on a frequent basis. Request a free copy of your credit report and review it to ensure that your personal information is correct and that no account information is incorrect or incomplete. Contact the lender or creditor if you feel the information is incorrect or incomplete. You can also dispute the report with the credit bureau that provided it. Remember that reviewing your personal credit report or credit score has no effect on your credit ratings.

More about the Credit Score